Backstop AMM Liquidity (BAL)

As part of our transition to the upcoming Drift Liquidity Provider (DLP) token, The Backstop AMM Liquidity (BAL) program will be fully decommissioned on 7 August at 00:00 UTC+0.

Overview

Backstop AMM Liquidity (BAL) is a way for users can opt provide backstop liquidity to selected markets. This action increases liquidity in the market's virtual Automated Market Maker (AMM), enhancing execution quality for other users by reducing price impact.

Adding shares to the Liquidity provision involves boosting sqrtK for the AMM's oracle-based constant product liquidity. Increasing sqrtK thereby increasing the liquidity pool. Notably, liquidity added to perpetuals markets is cross-margined within Drift, allowing users to earn lending interest and access capital for margin trading.

For a detailed understanding of BAL functionality, refer to the BAL Technical Explainer.

BAL involves leverage and opens perpetual positions on behalf of the user.

This requires the user to actively manage their account's inventory / risk for best results.

Before using BAL, even with low leverage, please read through all the documentation careful.

Getting Started with BAL

You’ll take on a share of the AMM’s positions as a counterparty to other Drift traders. For example, if a Drift trader goes short, you’ll receive a long position.

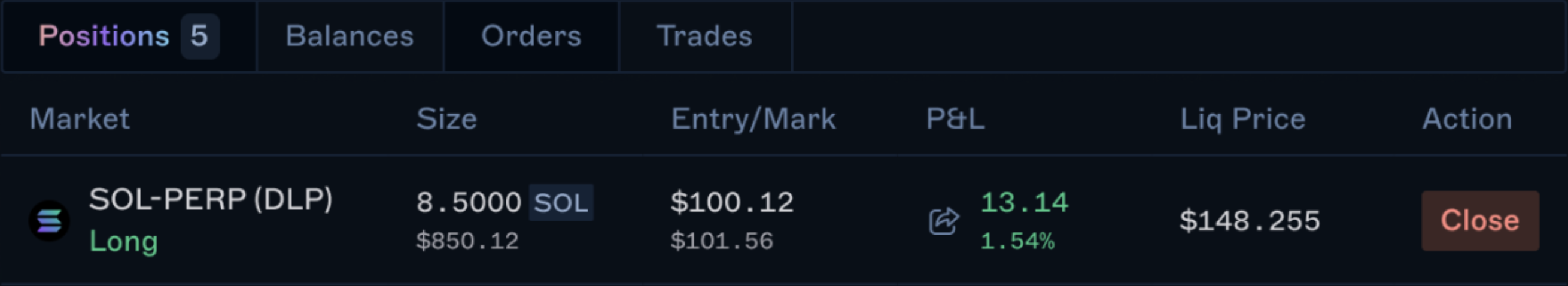

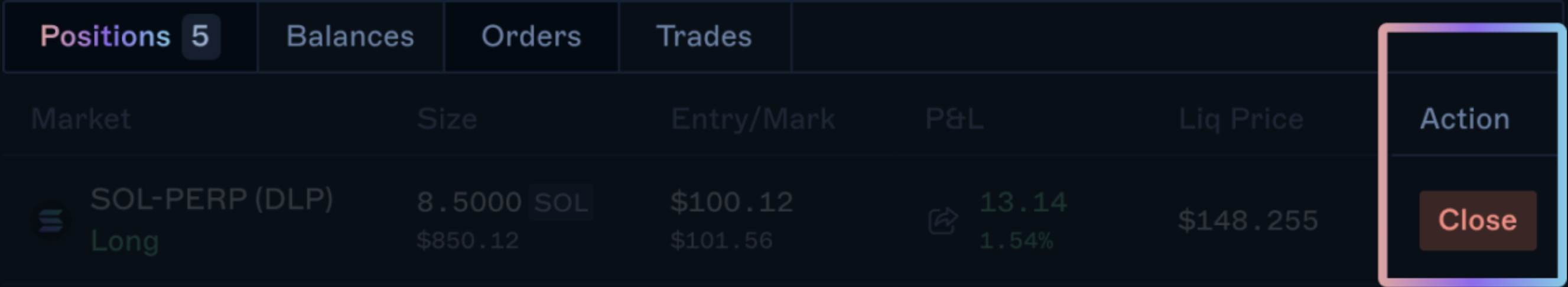

Your liquidity is represented as open orders (bids/asks) and you’ll see your BAL positions in the positions table:

Position Updates & Management

Adding BAL shares, As new trades are filled, your perp position in that market can be updated.

Reducing BAL shares reduces the flow of updates to that market's perp position.

The exact flow of position depends on the fill action vs the AMM (this can be a proto-rata split of protocol-owned and user-owned liquidity or just one or the other). Note that BAL does not get a share of AMM/JIT split fills.

The AMM can fill as a backstop and participate along side other user maker orders to partially rebalance inventory.

Learn more about how the AMM fills order

You can manage your risk manually by reducing the perp position or closing it via the close button in the positions table.

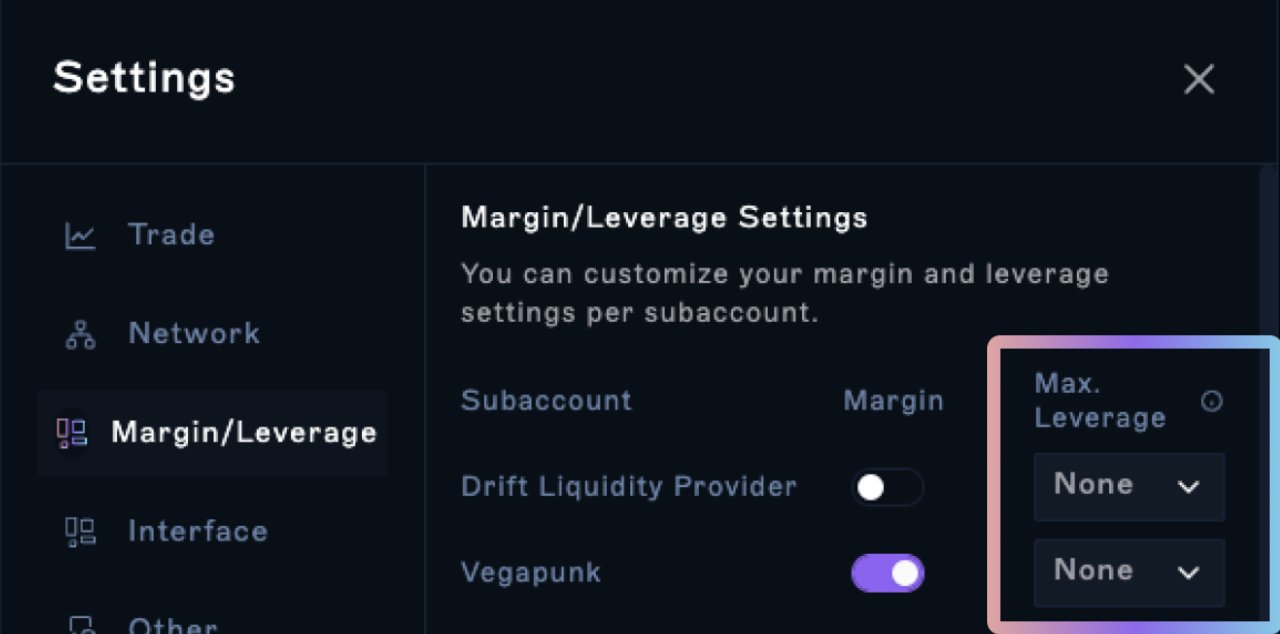

Setting max leverage for your subaccount

A subaccount max leverage is suggested when you add liquidity but can be adjusted in the settings. This setting adjusts your margin requirement for increasing BAL positions. If your account falls below the collateral requirement shown on BAL page, the next P&L settle will trigger de-risking of the position. You can also opt out of this in Margin/Leverage Settings.

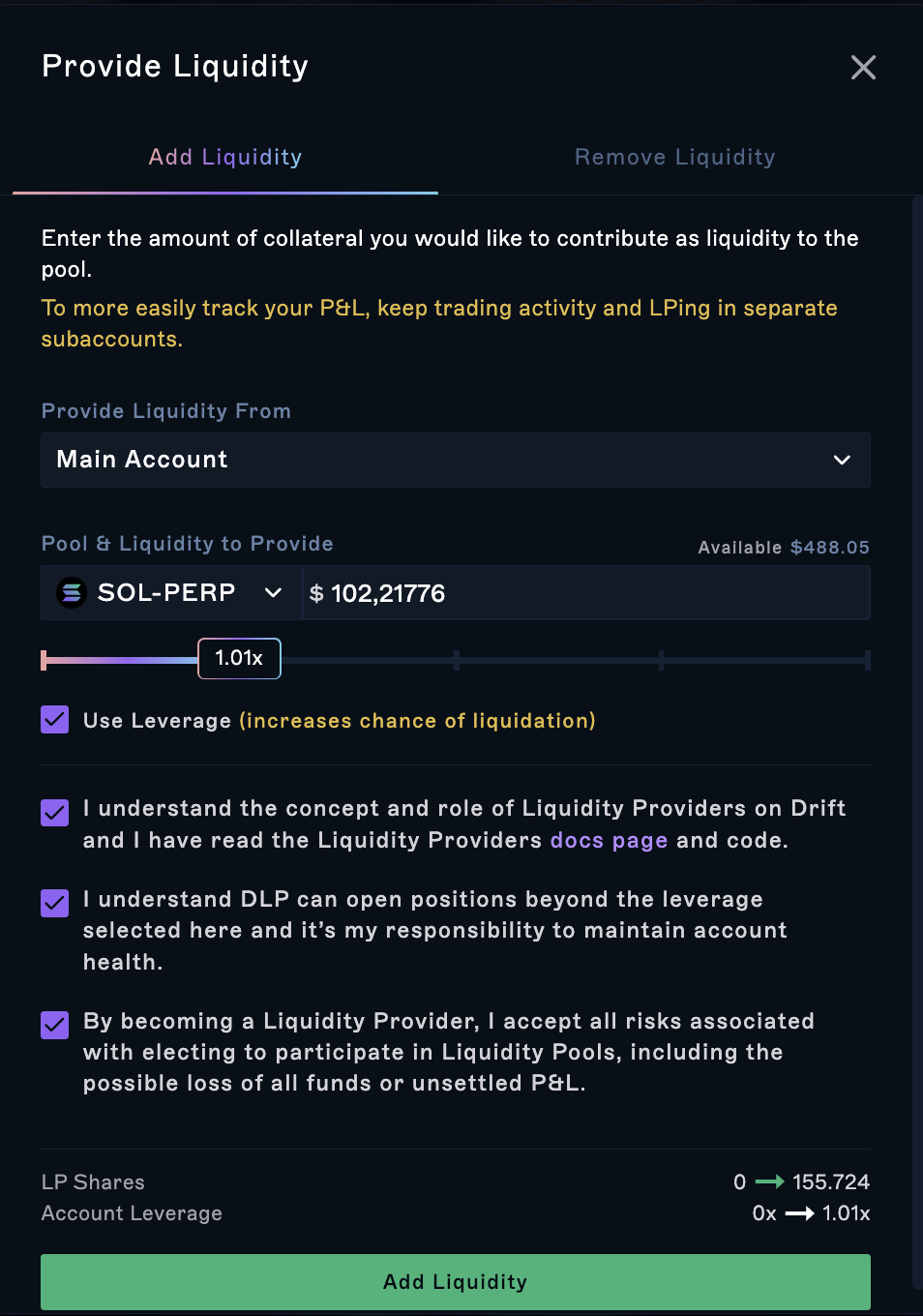

How to add liquidity to BAL

To add liquidity to a perpetual market:

- Select the market you'd like to be an LP for and click

Add

- In the modal, enter the amount you'd like to provide or the leverage

- Click

Add

You may be prompted to create a subaccount for BAL. This is highly recommended in order to easily track BAL and trading P&L.

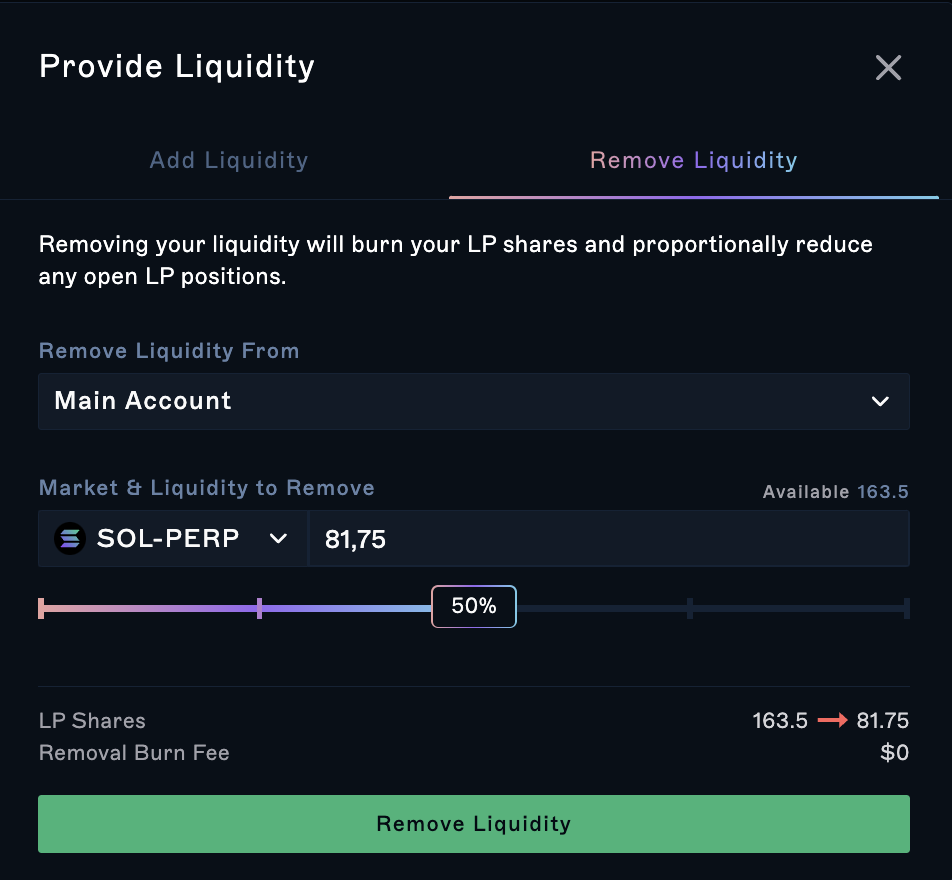

How to remove liquidity

You can remove liquidity from the Trading page under the positions tab or you can access it from the BAL page:

- Click

Remove

- Select the amount of shares you'd like to remove

- Click

Remove Liquidity

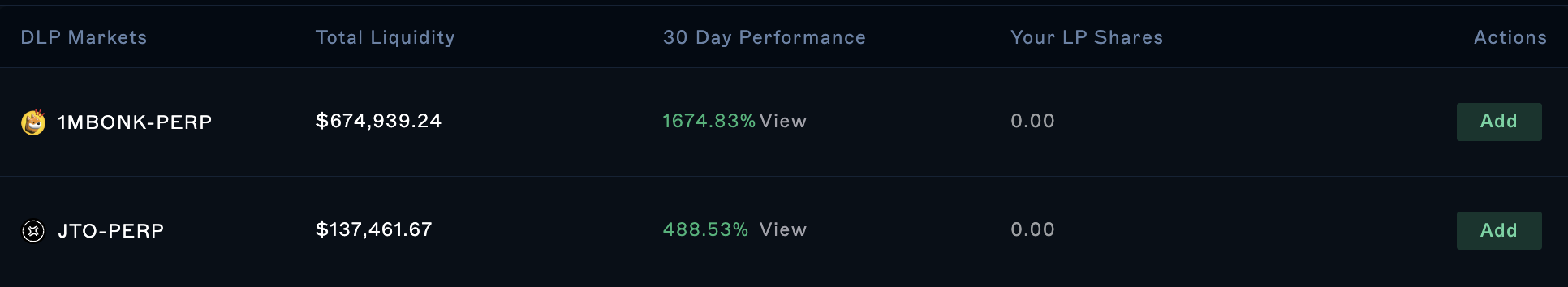

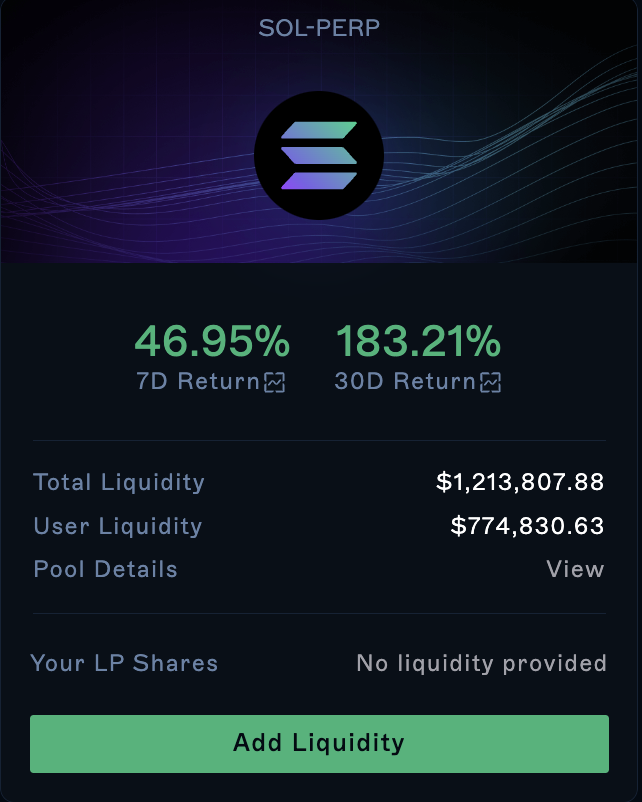

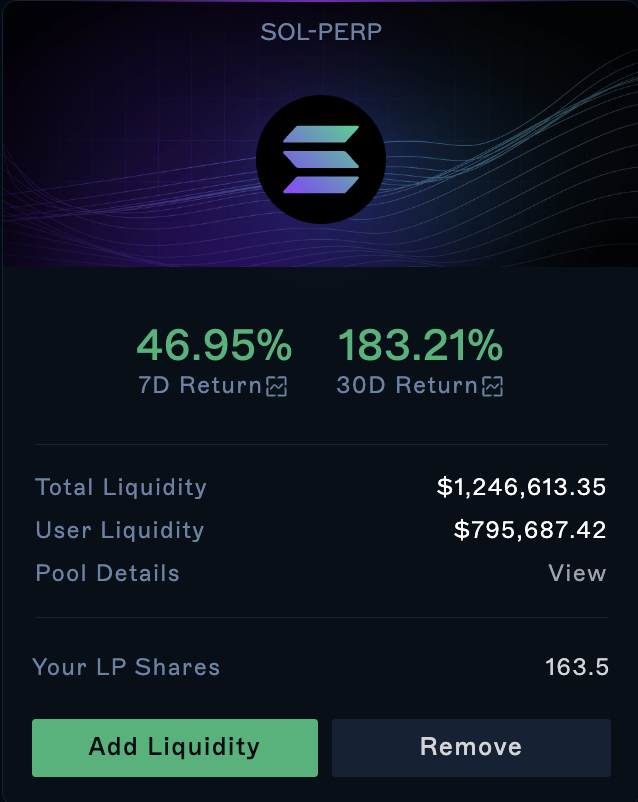

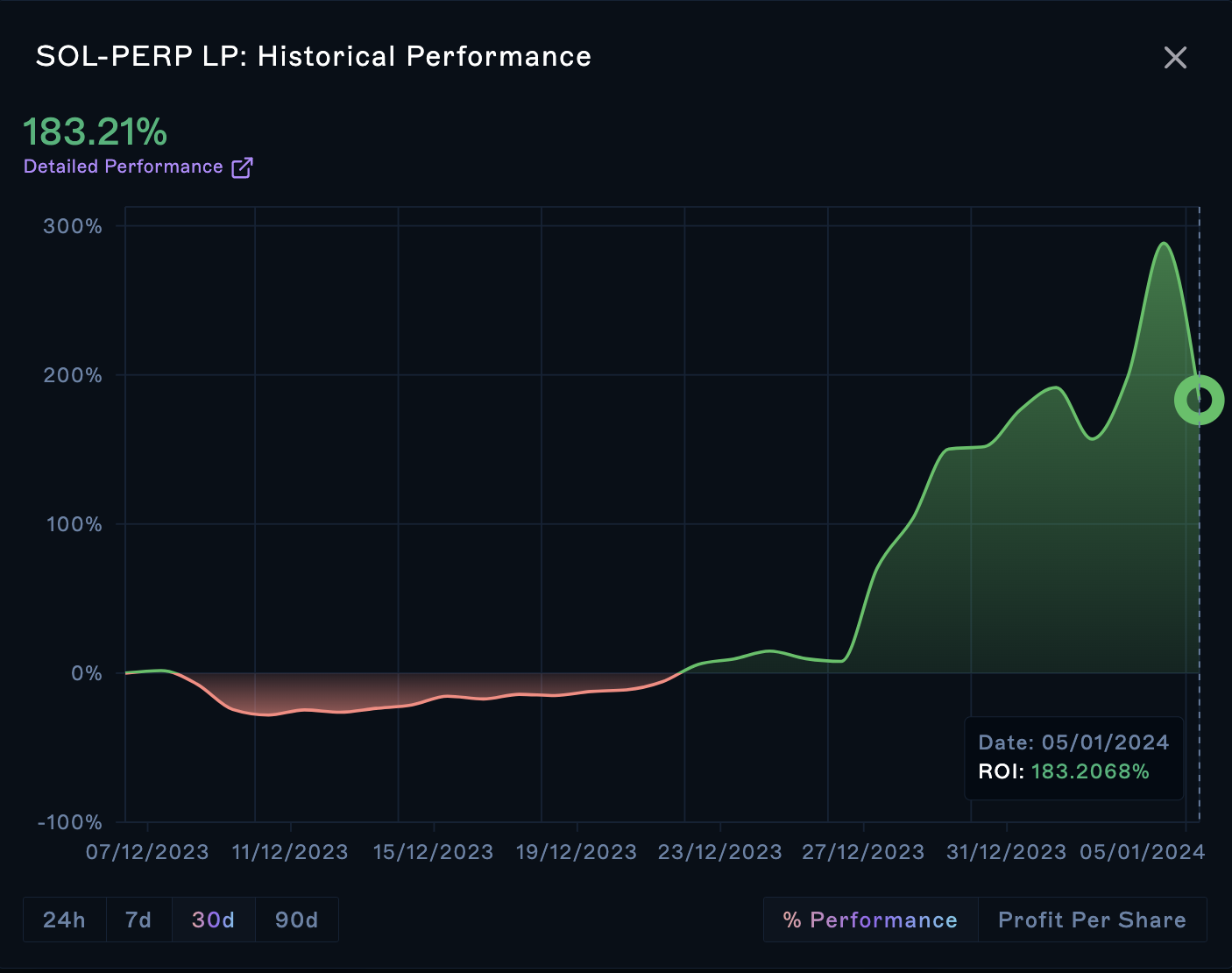

How to view the historical performance for each market

There are 2 ways to access historical performance:

- You can click on the 7D or 30D performance in each markets card

- or, in table view, you can click

View Performanceunder the 30D Performance column