Borrow Interest Rate

Drift’s lending pools use a borrow interest rate model inspired by Aave . Each spot market defines:

- A minimum rate

R_min - An optimal rate

R_optat a target utilizationU* - A maximum rate

R_maxat full utilization

The borrow interest rate is a function of utilization (U), or how much capital in the pool is currently lent out.

Utilization Rate and Liquidity

- If U is high -> there is abundant capital within the system and the protocol users are given incentives in the form of low-interest rates to encourage borrowing

- If U is low -> capital within the system is scarce and the protocol will increase interest rates to incentivise more capital supply and repayment of debt.

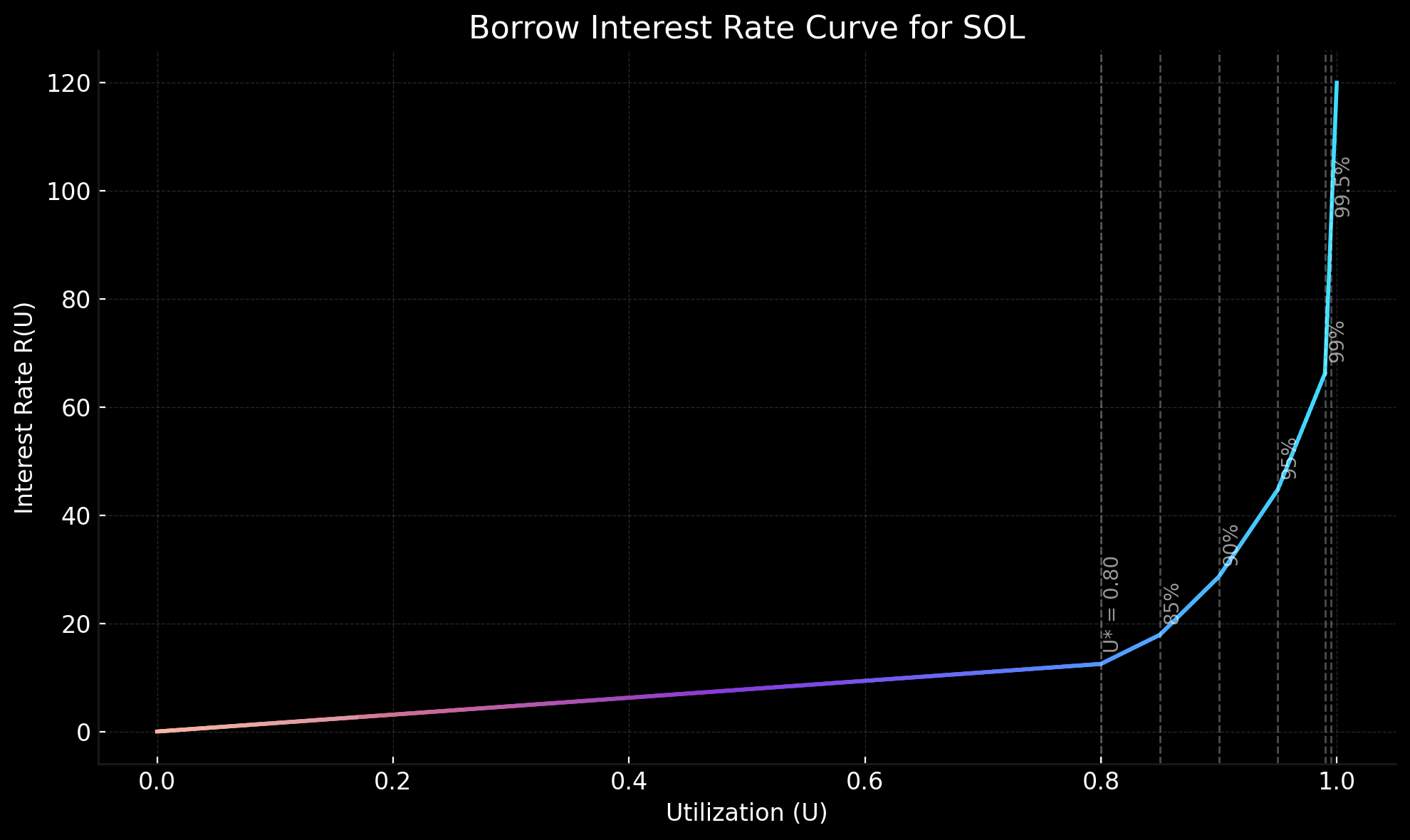

Multi-Kink Interest Rate Model

To balance capital efficiency with liquidity protection, Drift uses a multi-kink model. This allows linear rates up to the optimal utilization point, and then introduces increasingly steeper rate hikes as utilization increases, especially in the 85–100% range.

This design allows for more aggressive max utilization rates while not adding too much rate volatility near optimal rate.

Formula

The interest rate function is defined as:

Graph

This graph demonstrates the multi-kink interest rate model as configured for the SOL market.

These values are subject to change, as each spot market defines its own parameters.

The latest values can be retrieved directly from the on-chain SpotMarketAccount data.

Summary Table

| Utilization (U) | Rate Curve Behavior |

|---|---|

| U ≤ U* | Linear ramp to R_opt |

| U* to 0.85 | Mild penalty rate slope(+50 bps) |

| 0.85 to 0.90 | Steeper slope (+100 bps) |

| 0.90 to 0.95 | Steeper still (+150 bps) |

| 0.95 to 0.99 | Aggressive slope (+200 bps) |

| 0.99 to 0.995 | Near-vertical slope (+250 bps) |

| 0.995 to 1.00 | Max slope (+250 bps) |

Last updated: May 2025.